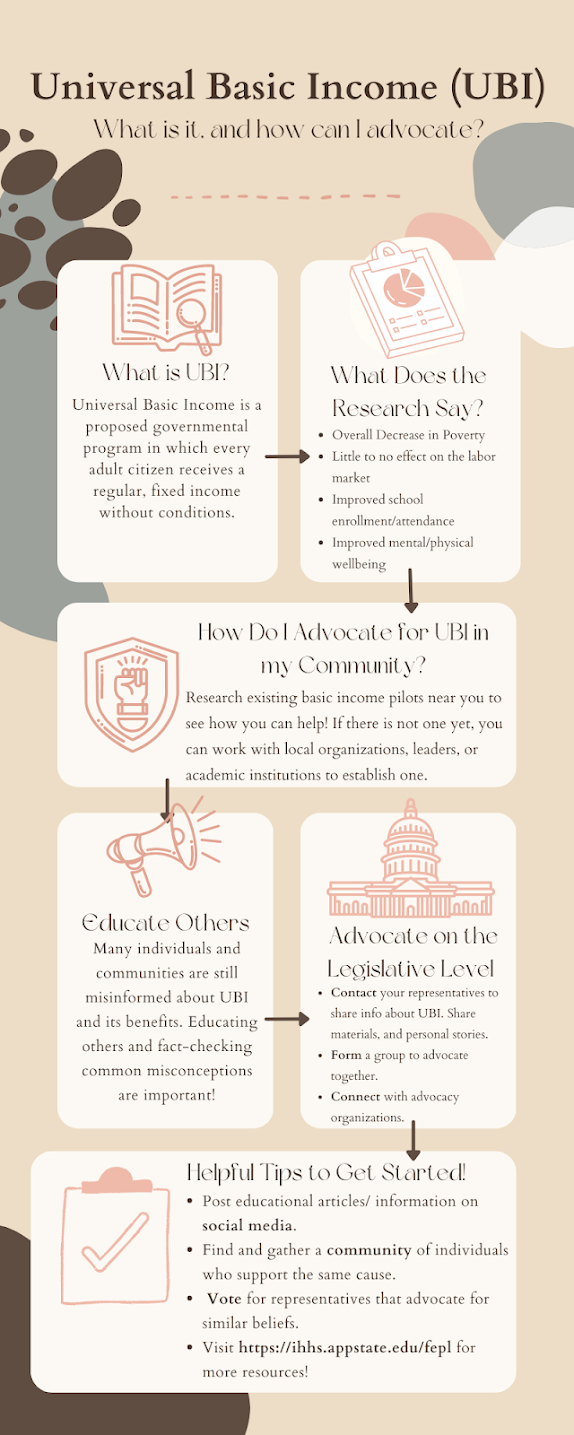

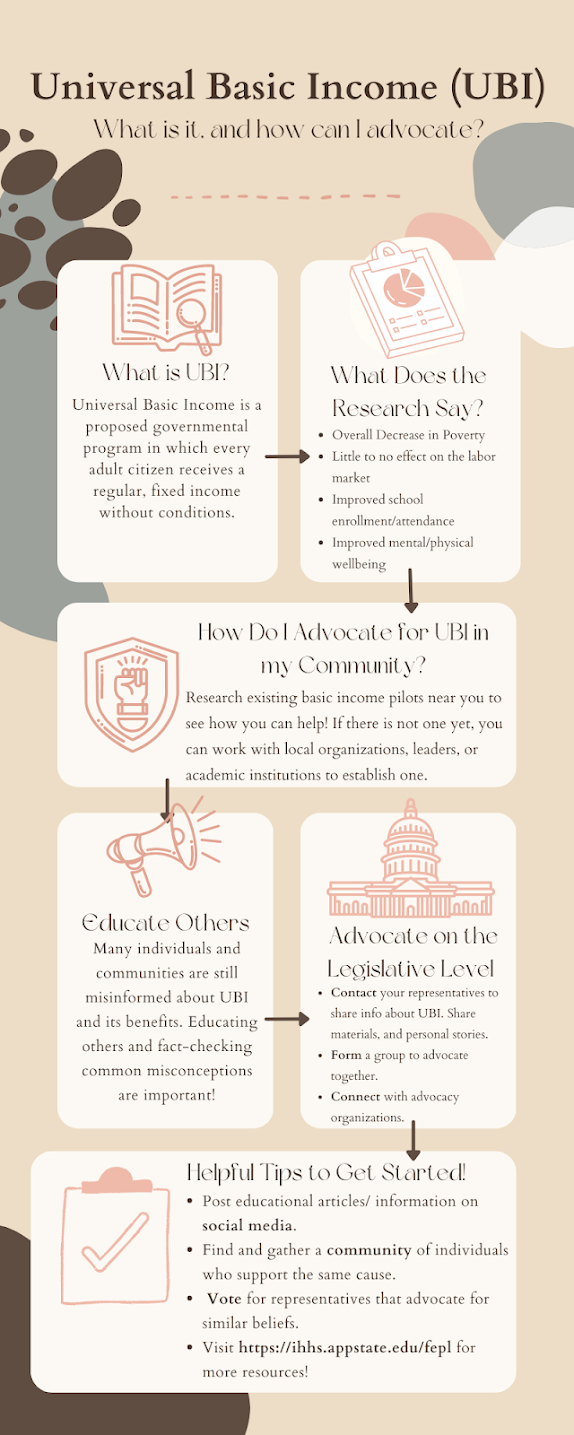

Universal Basic Income (UBI), sometimes referred to as basic income, or guaranteed income, was made popular in current conversation by 2020 Democratic Presidential candidate, Andrew Yang. Providing a guaranteed income for citizens is not a newfound concept, rather, discussions of regular, guaranteed payment to all citizens are found throughout history. The creation of the concept of UBI was fueled by the need to rethink our current welfare state. With heightened levels of inequality, and fear for the future of welfare, research into the effectiveness of UBI is growing each year. Therefore, although the topic of UBI is growing in news and politics, many are still unaware of the basics. There are currently many different models of UBI, and most models include a few common components. These commonalities include, the money being provided to individuals, usually on a monthly basis. The money is distributed as cash and is non-conditional. This means that the mo